Introduction

In Part 1, we covered fundamental techniques in stock market analysis. Building upon that foundation, Part 2 delves into advanced methods to further enhance your understanding and proficiency in analyzing the stock market dynamics.

1. Advanced Statistical Methods

Regression Analysis

Regression analysis is a statistical method used to model the relationship between one or more independent variables and a dependent variable. In the context of stock market analysis, regression can help us understand how various factors such as market indices, economic indicators, or company fundamentals influence stock prices. Let’s explore different types of regression models, including linear regression, polynomial regression, and logistic regression, and demonstrate their application using real-world examples.

# Example code for linear regression

import statsmodels.api as sm

# Define independent and dependent variables

X = df[['Market_Index', 'Fundamental_Factor']]

y = df['Stock_Price']

# Fit linear regression model

model = sm.OLS(y, X).fit()

# Print regression results

print(model.summary())Time Series Forecasting

Time series forecasting involves predicting future values based on historical data patterns. In stock market analysis, accurate forecasting is crucial for making informed investment decisions. We’ll delve into popular time series forecasting techniques such as Autoregressive Integrated Moving Average (ARIMA), Exponential Smoothing Methods (e.g., Holt-Winters), and Long Short-Term Memory (LSTM) neural networks. Through practical examples, we’ll illustrate how to leverage these methods to forecast stock prices and assess their predictive performance.

# Example code for time series forecasting with ARIMA

from statsmodels.tsa.arima.model import ARIMA

# Fit ARIMA model

model = ARIMA(df['Stock_Price'], order=(5,1,0))

model_fit = model.fit(disp=0)

# Forecast future prices

forecast = model_fit.forecast(steps=10)

print(forecast)Machine Learning Models

Machine learning offers powerful tools for analyzing complex data and extracting valuable insights. In the realm of stock market analysis, machine learning algorithms can be used for tasks such as pattern recognition, classification, and clustering. We’ll explore various machine learning algorithms, including decision trees, random forests, support vector machines (SVM), and gradient boosting, and discuss their applications in predicting stock price movements, identifying trading signals, and optimizing investment strategies.

# Example code for decision tree classification

from sklearn.tree import DecisionTreeClassifier

# Define features and target variable

X = df[['Feature1', 'Feature2', 'Feature3']]

y = df['Target']

# Initialize decision tree classifier

clf = DecisionTreeClassifier()

# Fit classifier to training data

clf.fit(X_train, y_train)

# Predict class labels for test data

predictions = clf.predict(X_test)2. Sector Analysis

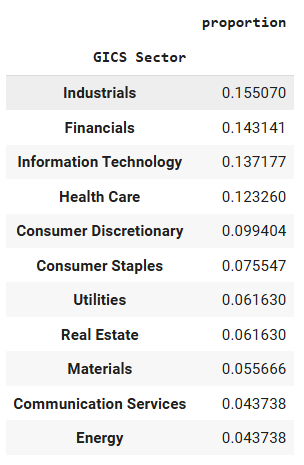

Sector Performance Metrics

Analyzing sector performance provides valuable insights into the broader market trends and can help investors identify lucrative opportunities or potential risks. We’ll discuss key performance metrics used in sector analysis, such as sector rotation strategies, relative strength analysis, and sector correlation matrices. Through case studies and empirical research, we’ll illustrate how sector analysis can inform sector allocation decisions and enhance portfolio diversification strategies.

# Example code for sector correlation matrix

sector_corr = df.groupby('Sector').corr()

print(sector_corr)Sector-Specific Factors

Each sector within the stock market is influenced by a unique set of factors that drive its performance. Understanding these sector-specific dynamics is essential for conducting effective sector analysis. We’ll examine common sector-specific factors such as regulatory environment, technological innovation, consumer behavior, and macroeconomic trends, and discuss their implications for sector analysis and investment decision-making.

3. Risk Management Strategies

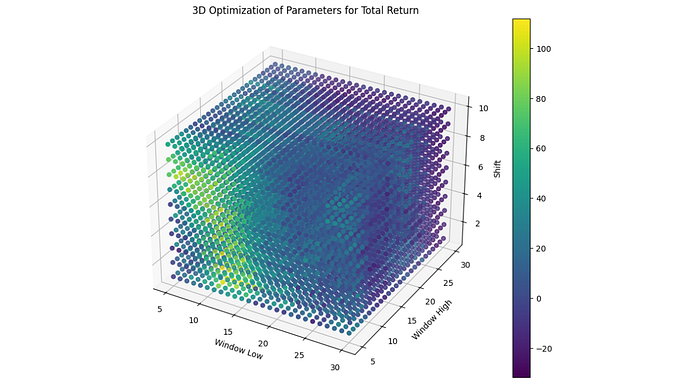

Portfolio Optimization Techniques

Effective risk management is paramount in portfolio management to mitigate potential losses and achieve optimal risk-adjusted returns. We’ll explore advanced portfolio optimization techniques, including mean-variance optimization, Markowitz portfolio theory, and Black-Litterman model. By optimizing portfolio allocations based on risk-return trade-offs and diversification benefits, investors can construct well-balanced portfolios tailored to their risk preferences and investment objectives.

# Example code for portfolio optimization

from pypfopt.efficient_frontier import EfficientFrontier

from pypfopt import risk_models

from pypfopt import expected_returns

# Calculate expected returns and covariance matrix

mu = expected_returns.mean_historical_return(df)

S = risk_models.sample_cov(df)

# Optimize portfolio for maximum Sharpe ratio

ef = EfficientFrontier(mu, S)

weights = ef.max_sharpe()

print(weights)Tail Risk Hedging Strategies

Tail risk refers to the risk of extreme or unexpected events that can have a significant impact on portfolio performance. Tail risk hedging strategies aim to protect portfolios against adverse market movements and catastrophic events. We’ll discuss popular tail risk hedging techniques such as options strategies (e.g., put options, collars, and straddles), volatility derivatives (e.g., VIX futures and options), and alternative investments (e.g., gold, commodities, and alternative risk premia). Through theoretical frameworks and practical examples, we’ll illustrate how these strategies can enhance portfolio resilience and reduce downside risk exposure.

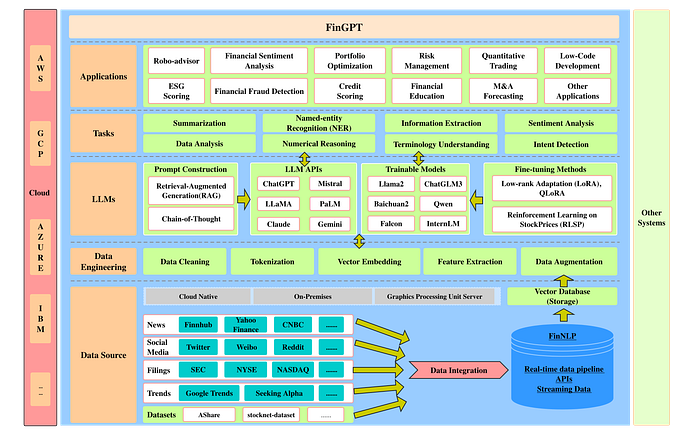

4. Sentiment Analysis

Market Sentiment Indicators

Market sentiment is the general attitude or feeling of investors towards the market, or, the assets. Sentiment analysis quantifies and analyzes the attitude of the investors from different data sources, such as social media, news items, online forums, etc. We will discuss various sentiment analysis techniques: Natural Language Processing, sentiment lexicons, and machine learning models for sentiment classification. Incorporating market sentiment indicators into investment decisions, whether as an individual investor or investment firm, provides great insights into market psychology and sentiment-driven price movements.

# Example code for sentiment analysis

from nltk.sentiment.vader import SentimentIntensityAnalyzer

# Initialize sentiment analyzer

sia = SentimentIntensityAnalyzer()

# Calculate sentiment scores for news articles

sentiment_scores = df['News'].apply(lambda x: sia.polarity_scores(x))

print(sentiment_scores)Principles of Behavioral Finance

Behavioral finance tries to explain how psychological biases and cognitive errors may influence investor behavior and market outcomes. Understanding the principles of behavioral finance can enable investors to pinpoint and reduce cognitive biases, like overconfidence, loss aversion, and herding. We will review the major concepts within behavioral finance, such as Prospect Theory, Framing, and Cognitive Heuristics, and analyze their implications for investment decision-making and risk management.

5. Case Studies

Real-World Applications

To demonstrate the practical application of advanced stock market analysis techniques, we’ll present real-world case studies showcasing how these methods can be used to generate alpha, manage risk, and optimize investment performance. Through in-depth analysis of historical market data and empirical research, we’ll highlight successful investment strategies and lessons learned from market anomalies, behavioral biases, and unexpected events.